Top Global Oil Producers

OPEC Member Countries

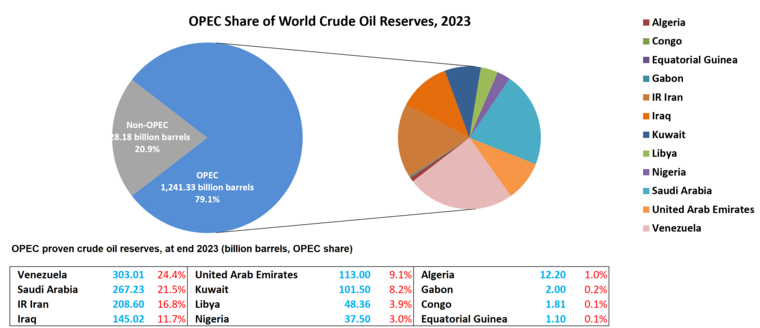

OPEC’s influence in the oil game is hard to ignore. These countries are the oil champs, handling about 40% of the crude output. They’re also MVPs in the trade world, managing 60% of the petroleum stirring things up on the global market (EIA). Saudi Arabia, Iraq, and UAE are some of the big shots leading this pack.

OPEC Member Countries in 2023

| Country | Production (Million Barrels per Day) |

|---|---|

| Saudi Arabia | 11.1 |

| Iraq | 4.5 |

| UAE | 3.5 |

United States and Saudi Arabia

Stepping into the oil arena, the United States and Saudi Arabia are headliners. The U.S. takes the lead with almost 22 million barrels a day in 2023, snagging about 22% of the world’s share (Investopedia). Right behind, Saudi Arabia churns out 11.1 million barrels daily, with its oil swagger making up 42% of the GDP, 87% of the budget, and a whopping 90% of export earnings (Investopedia).

Top Two Oil Producers in 2023

| Country | Production (Million Barrels per Day) |

|---|---|

| United States | 22.0 |

| Saudi Arabia | 11.1 |

For more on global oil production, dig into list of countries by military spending.

Russia and Canada

Russia and Canada also pack a punch in oil production. Russia holds its ground as the third-biggest oil maker, cranking out 10 million barrels every day. Canada follows with around 5.5 million barrels daily in 2023 (Investopedia).

Top Oil Producers: Russia and Canada

| Country | Production (Million Barrels per Day) |

|---|---|

| Russia | 10.0 |

| Canada | 5.5 |

If you’re curious about how things have changed over time, take a look at production trends over the years.

For more interesting lists, wander over to list of countries by happiness and list of countries by iq.

Contributions to Global Oil Production

Peeking into the oil contributions from various countries gives us a glimpse into how the energy market across the globe ticks. We’ll chat about the top oil kings, how the trends have played out over time, and what this all means for oil prices around the planet.

Leading Oil Producers of 2023

In 2023, the oil champs were:

- United States

- Saudi Arabia

- Russia

- Canada

- China

The United States was the big cheese here, pumping out nearly 22 million barrels a day, grabbing 22% of the oil pie worldwide (Investopedia).

Check out this table to see what the top five oil producers were serving up:

| Country | Production (Million Barrels/Day) | Global Share (%) |

|---|---|---|

| United States | 21.9 | 22 |

| Saudi Arabia | 10.5 | 11 |

| Russia | 10.2 | 10 |

| Canada | 5.3 | 5 |

| China | 4.9 | 5 |

Dive deeper into country nuances with our related section on countries by military spending.

Production Trends Over the Years

Watching the shifts in who produces the most oil is like seeing a championship game of musical chairs. The U.S. has been the top dog for six years straight, with 2023 hitting a home run at an average of 12.9 million barrels daily and a December slam of over 13.3 million a day (Yahoo Finance).

Russia and Saudi Arabia, tag-teaming with the U.S., cranked out 40% of the world’s oil (IEA). For a bit of a history lesson and some head-to-head comparisons, check out countries of ussr.

Impact on Global Oil Prices

When the oil faucet opens wide, prices tend to drop. The major oil hitters, like the U.S., Russia, and Saudi Arabia, can flood the market or cut back, causing prices to rise and fall like a seesaw.

The oil game also gets spicy with geopolitics, OPEC rules, and new production hurdles adding twists to the pricing rollercoaster.

For some more intrigue into global affairs, peek into our list of countries by homicide and list of countries banning 5g to see other global currents in action.

Oil Production Challenges

Volatility in Oil Prices

The rollercoaster ride of oil prices is like a soap opera with all its twists and turns. The world’s oil prices can swing wildly due to hiccups in supply, political drama, or sudden changes in how much oil folks want. OPEC countries, old hands in the oil game, churn out about 40% of the planet’s crude oil, giving them the power to shake up prices. When they decide to fiddle with how much oil they pump out or play nice with agreed quotas, it can send prices on a wild ride (EIA).

| Year | Average Brent Crude Oil Price (USD per barrel) |

|---|---|

| 2019 | 64.3 |

| 2020 | 41.7 |

| 2021 | 70.9 |

| 2022 | 100.0 |

Geopolitical Events

The world of oil production and prices is quite the soap opera, with political and regional tensions often playing key roles. Battles and squabbles between or within oil-rich nations can shake up oil supplies, sending shockwaves through the market. Take the Middle East, for example. If things get hairy there or nations face sanctions, the oil production can dip drastically (EIA). Big players like Saudi Arabia, cranking out 11.1 million barrels daily, have a hand in how these things play out, with their actions echoing across global markets (Investopedia).

Compliance with Production Targets

Imagine trying to herd cats—managing oil production targets can be just as tricky. OPEC sets these targets, hoping to keep the oil sea calm and steady. However, it’s not always a smooth sail, as some countries might overstep their quotas, thanks to money troubles or domestic issues, stirring up the oil waters (EIA).

| Country | Compliance Rate (%) |

|---|---|

| Saudi Arabia | 105 |

| Iraq | 73 |

| Nigeria | 65 |

| Venezuela | 50 |

It’s like a tangled web with oil prices, political tussles, and shaky compliance with production goals weaving the world of oil. These elements don’t just set the day’s oil flows; they shape the long-term economic health of nations heavily leaning on oil. Curious about what makes these countries tick? Check out our deep-dive into the challenges faced by oil-dependent economies.

Rising Oil Stars

New players in the oil scene make waves worldwide. As the need for oil ebbs and flows, places like Brazil and Iraq have stepped up their game, pumping out more oil than ever before. Here’s a closer look at what they’re doing and how things are changing in the oil biz.

Brazil’s Boom

Brazil is on fire in the oil department. Just recently, they hit their highest record yet in oil and gas production. In 2023, Brazil cranked up crude oil production by about 13%, hitting over 3.4 million barrels a day. They also saw natural gas production rise by 8.7% (Yahoo Finance). This leap forward is thanks to some fancy new-tech tools and opening up fresh oil fields.

| Year | Crude Oil Production (million barrels/day) | Growth in Natural Gas (%) |

|---|---|---|

| 2023 | 3.4 | 8.7 |

Brazil keeps climbing up, making sure everyone knows it’s a big deal in the new oil club. For more rising stars, peek at our list of countries by oil production.

Iraq’s Steady Flow

Iraq isn’t just chilling; it’s the sixth-biggest oil producer around and the second in the OPEC league, right behind Saudi Arabia. In 2023, Iraq pushed out around 4.2 million barrels every single day (Yahoo Finance). Even with all sorts of challenges like politics and inner turmoil, Iraq keeps its oil tap flowing strong.

| Year | Oil Production (million barrels/day) |

|---|---|

| 2023 | 4.2 |

Iraq’s steady numbers highlight its heavyweight role in the global oil scene. Dive deeper with our list of apec countries.

Changing Oil Game

The oil world is spinning differently with these new go-getters stepping up. Brazil and Iraq are just the tip of the iceberg when it comes to how things are shifting. Better technology, fewer political hiccups, and more cash in oil setups keep shaking things up.

| Country | 2023 Oil Production (million barrels/day) |

|---|---|

| Brazil | 3.4 |

| Iraq | 4.2 |

With these rising countries joining the oil chat, the global oil game is seeing a bit of a shake-up. Curious folks can see how this influences other sectors by checking out our list of countries by iq and list of countries by happiness.

To get the lowdown on what’s tough and what’s coming next for oil-heavy nations, explore our bits on Oil Production Challenges and Regional Oil Production Trends.

Oil Production and Economic Stability

Oil’s not just black gold—it’s a lifeline for many countries’ economies. For places that rely heavily on that sweet crude cash, the push towards green energy means they’re walking a tightrope. Let’s see how these nations are trying to keep their balance.

Diversification Efforts

Trying to switch up the money game isn’t easy for oil giants. Since the oil price crash in 2014, it’s been a wild ride. Take Saudi Arabia, for instance—they cranked up the oil pumps to keep the cash flowing, but it’s not all rosy as their foreign exchange reserves took a hit (CNBC).

Some nations are playing it smart by betting on tourism, tech, and solar panels. Yet, not every country’s shuffling at the same pace. The ups and downs of oil prices and political drama add layers to this tricky puzzle.

Challenges Faced by Oil-Dependent Economies

Oil-dependent economies are juggling a bunch of tricky hurdles:

- Volatility in Oil Prices: Global price swings can mess up budgets. Nigeria and Algeria know this all too well, with high costs keeping them on edge.

- Geopolitical Instability: Keep an eye on the political chessboard. Iraq and Chad might face storms as the world leans into renewable energy.

- Economic Adjustments: Switching gears from oil isn’t a cakewalk for many, causing slowdowns or setbacks in diversification after 2014’s crash.

For these oil-focused places, it’s a delicate dance with the markets, demanding clever policies to dodge the rough waves.

Future Prospects for Oil-Producing Countries

When it comes to the future, oil producers need a playbook full of adaptation and innovation. Big players like the U.S., Russia, and Saudi Arabia pumped out 40% (32.8 million b/d) of the world’s oil in 2023 (EIA). But even the titans aren’t immune to shifts.

| Country | 2023 Oil Production (million b/d) |

|---|---|

| United States | 12.0 |

| Russia | 10.5 |

| Saudi Arabia | 10.3 |

| Canada | 5.2 |

| Iraq | 4.1 |

| China | 3.8 |

Looking ahead, the race towards solar, wind, and other renewables is opening doors—and slamming some shut. Embracing cutting-edge tech, pouring money into renewable projects, and mixing up economic recipes could be the triple threat that keeps these economies in the game.

Peek into our pieces on global oil demand and production and regional oil production trends for more nuggets. Plus, check out the scoop on countries banning 5G and military spending stats to see how oil moolah shakes up other arenas.

Global Oil Demand and Production

Forecasted Oil Demand Growth

In 2023, the world gobbles up just over 102 million barrels of oil each day, but don’t be surprised when it hits nearly 106 million barrels daily by the end of the decade. The uptick comes mostly from countries in Asia stepping up their game, with India needing more for transport and China using a chunk for jet fuel and those colorful petrochemical products. Meanwhile, the demand in fancy countries takes a little nap.

| Year | Oil Demand (Million Barrels/Day) |

|---|---|

| 2023 | 102 |

| 2030 (Projected) | 106 |

Expansion of Production Capacity

Don’t blink, or you’ll miss the surge in oil production! By 2030, global oil output is set to hit close to 114 million barrels a day, leaving the demand in the dust by about 8 million. Non-OPEC+ nations are doing the heavy lifting, with the US leading the parade, planning to add 2.1 million barrels a day all by itself. Countries like Argentina, Brazil, Canada, and Guyana are rolling up their sleeves too, aiming to toss in another 2.7 million barrels a day all together.

| Country | Additional Production Capacity by 2030 (Million Barrels/Day) |

|---|---|

| United States | 2.1 |

| Argentina, Brazil, Canada, and Guyana | 2.7 |

| Total Non-OPEC+ Increase | 4.8 |

Refining Capacity and Market Dynamics

Refineries are humming along with a projected boost of 3.3 million barrels a day from ’23 to 2030. Not as wild as it used to be, but still keeping pace with the thirst for refined oil goods. Toss in supplies from non-oil sources like biofuels and natural gas liquids, and the market’s got backup.

| Period | Refining Capacity Increase (Million Barrels/Day) |

|---|---|

| 2023-2030 | 3.3 |

For anyone with an appetite for numbers and countries mentioned here, check out more articles about countries by oil production and other lists on countries. Curious about how these shifts stir up geopolitical dramas or economies? Peek at our takes on military spending and where things get rowdy in the most violent countries worldwide.

Regional Oil Production Trends

Keeping an eye on where we get our oil these days is pretty crucial. Here, we’ll have a chat about what’s going on with oil in the Middle East and North America, plus what everyone’s talking about—the big energy shift.

Focus on the Middle East

The Middle East is a major player in oil, pumping out 31% of the world’s supply (Enerdata). Five of its countries are in the top ten producers globally—impressive, right?

| Country | Oil Production (Million Barrels per Day) | Global Rank |

|---|---|---|

| Saudi Arabia | 10.44 | 2 |

| Iraq | 4.45 | 6 |

| UAE | 3.79 | 7 |

| Iran | 3.19 | 9 |

| Kuwait | 2.75 | 10 |

Source: U.S. Energy Information Administration

OPEC, with many Middle Eastern countries onboard, holds the reins in keeping the oil market in check. These countries rely heavily on oil money, with oil making up a huge chunk of their GDP—like 43% in Iraq. It’s like you’ve got all your eggs in one basket, and with everyone talking about greener energy, it’s time to start finding new income sources.

North American Production Scene

North America’s got its own big shots in oil. The U.S. leads the pack with its shale pumps running hot. Canada’s not far behind, thanks to its oil sands.

| Country | Oil Production (Million Barrels per Day) | Global Rank |

|---|---|---|

| United States | 11.18 | 1 |

| Canada | 4.59 | 5 |

North America is all about high-tech gear and big-time infrastructure spending. These guys can speed up or slow down oil production like a sports car, making them a wild card in the world’s oil game. If you’re nerdy about how all of this oil stuff works in the U.S., we’ve got more for you in our list of US military base countries.

Impact of the Energy Shift

Everyone’s buzzing about renewables and cutting back on carbon emissions. This shift means oil-heavy countries could find themselves in hot water if they don’t diversify. A report suggests nations like Algeria and Nigeria might face unrest due to their oil dependence (CNBC).

It’s a heads-up that major changes are on the horizon. Countries battered by the oil addiction need to start cutting back on fossil fuels and think about other economic lifelines. Want the full scoop on these changes? Check out our piece on the list of Sub-Saharan countries.

By digging into what’s happening in the Middle East, North America, and these eco-friendly changes, you’re peeping into the future of the oil world. Check out related cool topics like list of countries by military spending and list of countries by happiness to get a fuller picture of what’s what globally.

Long-Term Outlook for Oil Markets

The future of oil markets is shaped by several important elements that influence global oil production and demand. Things like an expected supply surplus, the role of non-OPEC+ producers, and the expansion of refining capabilities all contribute to market stability.

Projected Surplus in Oil Markets

Oil markets around the globe might face a noticeable supply surplus this decade, thanks to slowing demand growth paired with increasing production capabilities. According to the IEA, even though refining capacity is expected to jump by 3.3 million barrels daily from 2023 to 2030, this is a slower climb compared to past trends. But don’t worry, the rise in supply for non-refined fuels like biofuels and natural gas liquids (NGLs) is likely to keep the demand for refined oil products in check during this timeframe.

Impact of Non-OPEC+ Producers

When it comes to boosting global production capacity to meet demand, non-OPEC+ producers will be key players. They’re expected to contribute to about 75% of the additional production capacity by 2030. The IEA highlights that the U.S. is looking to add an impressive 2.1 million barrels per day to these non-OPEC+ gains. Plus, countries like Argentina, Brazil, Canada, and Guyana are gearing up to chip in roughly 2.7 million barrels each day, combined.

| Country | Added Barrels per Day (by 2030) |

|---|---|

| United States | 2.1 million |

| Argentina, Brazil, Canada, Guyana | 2.7 million together |

This boost could shake things up in the global oil scene, potentially flipping geopolitical power dynamics and impacting economic stability for oil-dependent nations. It’s a story that echoes back to the production surge in the U.S., which jumped from a low of 5.0 million b/d in 2008, thanks to techy upgrades in fracking and drilling (EIA).

Refining Capacity Expansion and Market Stability

Growing the global refining network is a big deal for the future of oil markets. The expected uptick of 3.3 million barrels daily in refining capacity between 2023 and 2030, albeit short of historical records, should still cater to the hunger for refined oil products (IEA). This growth is vital for market steadiness, keeping the balance between supply and demand in check.

Here’s how refining capacity plans to stack up:

| Factor | Value |

|---|---|

| Expected Refining Capacity Expansion (2023-2030) | 3.3 million b/d |

| Trend Compared to History | Lower Than Past |

| Demand Fulfillment | Sufficient, Helped by Biofuels and NGLs |

Grasping the roles of these parts gives us a window into what’s next for the global oil puzzle. For insights on regional oil production shifts, dive into our pieces on the North American Production Landscape and the list of most violent countries.