Overview of Countries by GDP

What’s the big deal about Gross Domestic Product (GDP)? Well, it’s a number—a really important number—that tells you how much stuff a country makes in a year. Think of it like a country’s financial report card. GDP helps you figure out who’s running the economic show and who’s playing catch-up.

Exploring GDP Rankings

Now, let’s look at who’s leading the pack. These GDP rankings highlight the alpha dogs of the economic world. Thanks to the eggheads at the IMF and World Bank, we’ve got a nifty table showing some of the biggest hitters by GDP.

| Rank | Country | GDP (in billion USD) |

|---|---|---|

| 1 | United States | 22,675 |

| 2 | China | 16,642 |

| 3 | Japan | 5,378 |

| 4 | Germany | 4,799 |

| 5 | United Kingdom | 3,108 |

| 6 | India | 2,946 |

| 7 | France | 2,938 |

| 8 | Italy | 2,120 |

| 9 | Canada | 2,015 |

| 10 | South Korea | 1,743 |

Latest numbers from 2022 courtesy of IMF and World Bank

America’s been leading the charge for ages, taking the top spot on the global economy list ever since it raced past the Brits back in 1916. Meanwhile, China’s been burning rubber ever since it switched gears in ’78 to mix socialism with a sprinkle of free market magic, zooming up to numero dos by 2010.

India, once known mainly for its spicy curry, is cooking up some serious economic growth too. Since the ’90s, it’s been liberalizing its economy, helping it muscle its way up the ranks. Curious about how India turbocharged its growth? Check out the story in our India’s Growth Acceleration section.

Mind you, this table keeps it simple by listing GDP without adjustments. But if you want a true-to-life picture, you’ve gotta factor in Purchasing Power Parity (PPP). PPP levels the playing field by considering what money can actually buy—you know, the price of bread and all that. For more on how PPP works its magic, pop over to our section on the Impact of Purchasing Power Parity.

Remember, these figures are only part of the story. Economic development, social and environmental stuff, and trips down history lane also shape a country’s economic journey. For the whole picture, jump into our Regional Economic Trends for the scoop.

Fancy diving deeper into who’s doing what? Look at these lists:

Peek at these GDP rankings, and you’ll get a better grip on the global economic game, spotting not just the big players but also the up-and-comers eager for a taste of the action.

Factors Affecting GDP

Gross Domestic Product (GDP) is a head-spinning measure of how well a country’s economy is clicking. It’s the total value of just about everything produced within a nation’s borders. There’s a cocktail of factors stirring up GDP, and they’re pretty crucial in determining where a country ranks on the global stage. Check out the list of countries by GDP for a little context.

Economic Development Levels

The story of a country’s GDP often dances around its economic strut—whether it’s strutting like a peacock among developed countries or still finding its feet in the developing or underdeveloped world. Nations get sorted into categories based on stuff like GDP, how geared-up their industries are, and stats like the Human Development Index (HDI) (Investopedia). Places high up on the development ladder usually flaunt a beefy GDP thanks to their thriving industries and nifty handling of resources.

-

Industrialization: Places like the United States, Germany, and Japan have turbo-charged their economies with massive industrial power. This generally means more cash flowing through the economy. Meanwhile, other countries might be stuck at the starting block, grappling with little industrial pull.

-

Human Development Index (HDI): HDI is like a report card combining health, education, and income data. Those A+ students of the world have a more educated and pumped-up workforce, often cranking up the economy’s engine.

-

Economic Policies: Solid government moves in the realms of investment, innovation, and trading can catapult an economy forward. Generally, developed countries got their playbooks locked, focusing on sustained growth.

| Country | GDP (in trillion USD) | HDI | Development Level |

|---|---|---|---|

| USA | 21.43 | 0.926 | Developed |

| Germany | 3.85 | 0.946 | Developed |

| India | 2.87 | 0.647 | Developing |

Social and Environmental Factors

Social and environmental vibes can either toss a nation’s GDP into high gear or throw a wrench in the works. It all depends on how they’re playing their cards.

-

Population Growth: Having more people around can mean more hands on deck, but it can also mean stressing out services and resources. Countries handling this well can boost their labor force without things buckling under pressure—take a look at the ones on the list of developed countries.

-

Education Levels: Good schooling means sharper minds and brighter ideas, and that’s hot currency in boosting GDP. Look at the Scandinavian gang; their top-notch education standards shine through in their economic results.

-

Healthcare and Life Expectancy: Healthy folks work better and longer. It’s a no-brainer that countries like Japan and Norway, with sleek healthcare systems, show both hefty GDP and high life expectancy rates.

-

Environmental Sustainability: Treating nature kindly is crucial for the economy’s long game. When countries push nature too hard, their economies can take a hit. For instance, some African countries trip over issues like deforestation (BBC Bitesize).

| Factor | Impact on GDP |

|---|---|

| Population Growth | More workforce, possibly more stress |

| Education Levels | Boost in productivity and new ideas |

| Healthcare and Life Expectancy | Better labor output |

| Environmental Sustainability | Keeps economy running over the long haul |

Digging into these factors helps spot why some countries take the GDP crown while others lag behind. Wanna know more about how regions size up on GDP? Have a peek at our piece on regional economic trends and the list of countries by economic status.

Notable Global Economic Transitions

Let’s chat about how the economies across the globe have transformed over the years. Grasping these shifts gives a pretty good take on the list of countries by GDP.

USA vs. British Empire

Rewind to 1916, when the USA’s economy overtook the British Empire. Until then, the Brits were rocking the top spot, having nudged past the Qing Dynasty’s numbers a few decades prior (source).

| Year | Leading Economy | GDP (in billion USD) |

|---|---|---|

| 1870 | British Empire | 100 |

| 1916 | United States | 116 |

China’s Economic Transformation

China’s economic gears shifted big-time, moving toward a socialist market with a splash of privatization and deregulation. This move rocketed China up the global rankings, jumping from ninth place in 1978 to clinching second by 2010 (source).

| Year | China’s GDP Ranking |

|---|---|

| 1978 | 9th |

| 2010 | 2nd |

India’s Growth Acceleration

Since the early ’90s, India’s been on a roll, thanks to economic liberalization. This era kicked off a notable surge in India’s growth and development (source).

| Year | Major Milestone |

|---|---|

| Early 1990s | Economic Liberalization |

| 2020 | Big Growth |

Looking for more juicy economic comparisons and rankings? Check out our pages on the list of countries by GDP and list of BRICS countries. These pages dive deeper into global standings. For region-specific data, take a peek at list of African countries or list of Southeast Asian countries.

Sources of GDP Data

Getting the skinny on a nation’s economic pulse means diving into Gross Domestic Product (GDP) stats. We aren’t talking about any ol’ numbers here; we’re talking refined data dished out by the likes of the International Monetary Fund (IMF), the World Bank, and the United Nations Statistics Division. These folks know their stuff!

IMF and World Bank Reports

The International Monetary Fund (IMF) is like the oracle when it comes to GDP data, supplying the goods every April and October. They not only lay out the facts from the past year with no sugar-coating, but also take a stab at what’s coming down the pike. Whether it’s real GDP or inflation, these guys crunch the numbers in a single currency so you can compare apples to apples.

On the other side of the coin, the World Bank jumps in with their calculations, looking at how countries stack up in terms of cash flow and growth with both USD and PPP figures. This data sheds light on who’s booming and who’s busting across the boards.

United Nations Statistics Division

The United Nations Statistics Division (UNSD) delves even deeper into GDP factoids, piecing together a global jigsaw of economic standings and riches. Their treasure trove of historical GDP data is a goldmine for anyone looking to draw some serious insight or draft some savvy policies.

Summary Table of Key Sources

| Source | What’s in the Bag | How Often | The Goods |

|---|---|---|---|

| IMF | Drops GDP data and forecasts | Twice a year (April, October) | Real GDP, inflation, account balances |

| World Bank | Breaks down productivity and growth | Periodic peeks | GDP in PPP and U.S. dollars |

| UNSD | Tracks historical GDP data | On the regular | National wealth and economic showdowns |

These hotspots give you a solid ground to work from if you’re looking to compare nations or want to put some GDP rankings under your microscope. For more juicy details, you might want to hop over to other reads like the list of European countries, list of African countries, and the list of Asian countries. Happy exploring!

Impact of Purchasing Power Parity (PPP)

Understanding PPP Metrics

Purchasing power parity (PPP) is like a secret decoder ring for the global economy, helping folks understand price differences between countries using different currencies. From big-time economists and international big-wigs to confused investors and eager forex traders, a bunch of people turn to PPP to make sense of economic productivity and investment worth. It’s a bit more reliable than just peeking at a country’s nominal GDP because it brings the real economic vibes into focus.

The magic happens when PPP looks at the cost of a standard set of goods across countries. This trick helps balance out living costs and inflation hiccups worldwide. Take the iconic Big Mac, for example—it might lighten your wallet by $5 in the States but surprise you with a $2 price tag in India. PPP adjustments make these numbers meaningful, letting economists size up economies from different corners of the planet.

Benefits of Adjusting GDP Using PPP

Switching up GDP using PPP comes with some neat perks. It means that GDP comparisons take into account living costs and inflation shocks. That’s a major win for places dealing with sketchy currency swings or runaway inflation.

Heavyweights like the International Monetary Fund (IMF) and the Organization for Economic Cooperation and Development (OECD) swear by PPP metrics for making sense of economic forecasts and crafting globally impactful policies. These insights ripple through financial markets everywhere. Likewise, the World Bank churns out periodic reports, stacking up each country’s strides in productivity and growth in both PPP and U.S. dollar terms—aiding in sharpening global economic guesswork.

| Country | Nominal GDP (USD Billion) | GDP by PPP (Intl. $ Billion) |

|---|---|---|

| USA | 21,430 | 21,430 |

| China | 14,342 | 27,310 |

| India | 2,869 | 10,721 |

| Germany | 3,861 | 4,619 |

| Japan | 5,082 | 5,750 |

Thanks to PPP adjustments, China and India flex a bit more muscle than their modest nominal GDP suggests. It’s a clearer shot at grasping economic standings and uncovering each country’s true market mojo.

Moreover, places like India and Vietnam that have flung their doors open to international trade have seen rapid growth and a dip in poverty levels. Developing countries slashing tariffs in the ’80s often sprinted ahead in the ’90s, outpacing those stuck in the past.

Grasping and rolling with PPP metrics can dish out fresh perspectives on the list of countries by GDP, crafting clearer global economic reads. Comparing lineups of first-world countries or the list of developing countries using both nominal GDP and PPP provides a 360-degree economico-view, helping folks truly grasp their economic tales.

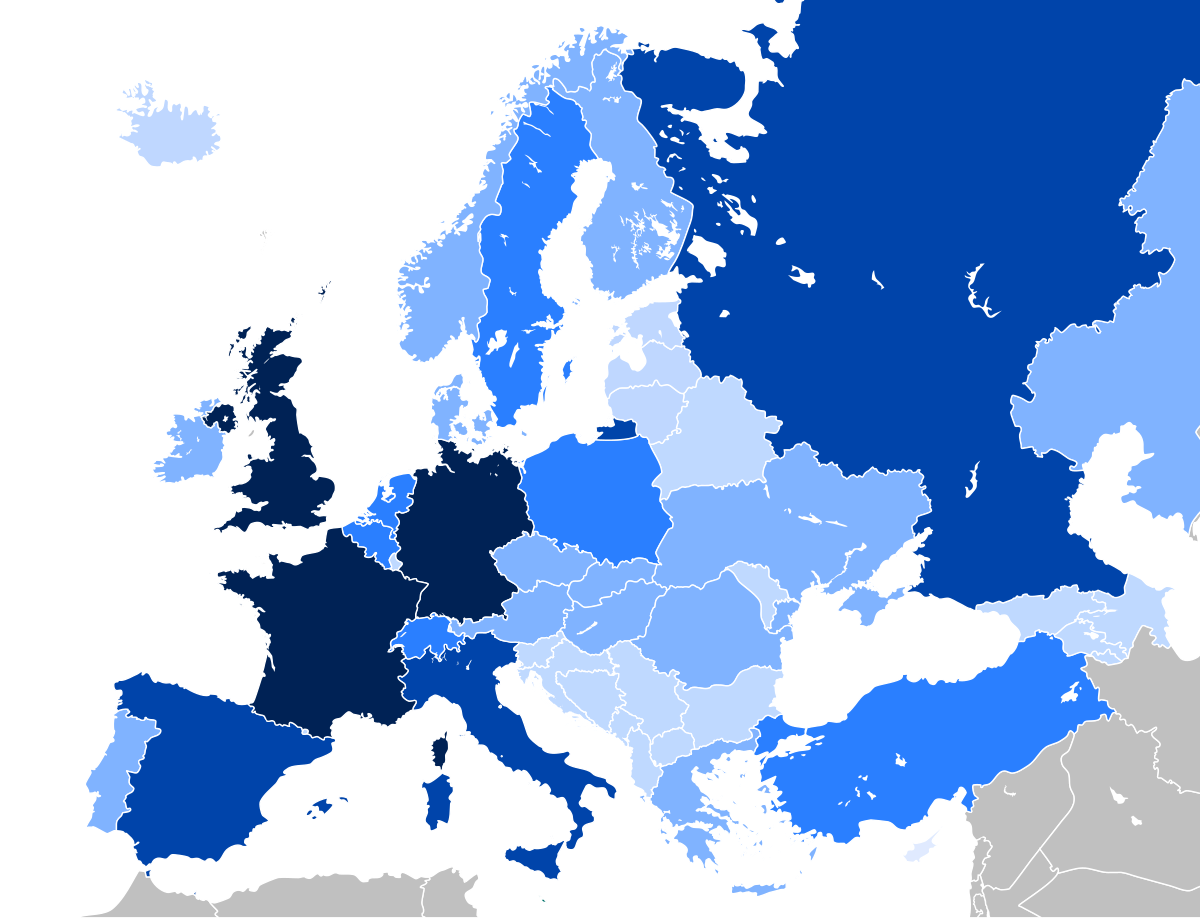

Regional Economic Trends

Economic Growth in South Asia

South Asia’s economy has been on a roll these past few decades, with an average GDP bumping up over 5% each year for the last forty years. Driving this economic roller coaster are powerhouses like India, Vietnam, Laos, and the Philippines (World Economic Forum).

| Country | Average Annual GDP Growth (%) |

|---|---|

| India | 7.0 |

| Vietnam | 6.8 |

| Laos | 6.5 |

| Philippines | 6.0 |

So, what’s behind this upward swing? A cocktail of a blooming middle class, tech leaps, and cash pouring in from overseas investments. Dive deeper into the economic pulse of these nations with our list of asian countries.

Challenges in African GDP Growth

Africa’s been on an economic seesaw—having moments of growth but struggling to keep the momentum. Sure, the continent had a good run from 2002 to 2011 with a growth crest of 4.5%, but since 2012, it’s been stuck at around 2-3% a year. On the bright side, that’s still above North America’s 2.0% and Europe’s/Central Asia’s 1.4% over the same period (World Economic Forum).

| Region | Average Annual GDP Growth (%) |

|---|---|

| Africa (2002-2011) | 4.5 |

| Africa (since 2012) | 2.5 |

| North America | 2.0 |

| Europe/Central Asia | 1.4 |

What’s causing the slowdown? Think political turbulence, shaky infrastructure, and a scarcity of financial support. To peek more into Africa’s economic saga, check out our list of african countries.

The ups and downs of regions like South Asia and Africa paint a richer picture of global economic rhythm. Understanding these trends sheds light on the hurdles and wins each nation tackles on its journey to economic progress.

Global Economic Growth Analysis

Real GDP Trends

Diving into real GDP (Gross Domestic Product) offers a lens to see the authentic economic boost in countries by factoring in inflation and charting an economy’s performance over the years. From 1970 to 2019, the global real GDP per person doubled, painting a picture of strong yet slower growth than nominal GDP, which soared 30 times over the same span. The noticeable disparity between these growth rates can be chalked up to things like inflation and how populations shifted (World Economic Forum).

| Year | Real GDP per Capita Increase |

|---|---|

| 1970 – 2019 | 2 times |

| Nominal GDP Growth | 30 times |

Peeking at countries like the United States, you’ll see that the middle income hopped up by only 40% during this timeframe, a snail’s pace compared to the GDP’s speed.

Impact of Globalization on Growth

Globalization really put its mark on economies worldwide, didn’t it? Studies spill the beans on how trade, foreign direct investment (FDI), and portfolio investment have stirred economic growth. Trading without borders and FDI, in particular, show a solid link with peppy growth rates (Investopedia). Such findings highlight why economic policies pushing international trade and investment could be game changers.

Knocking down trade walls could potentially skyrocket global GDP. Predictions point towards gains ranging from USD 250 billion to USD 680 billion each year from kicking merchandise trade barriers out the door (IMF). Countries still on the developmental ladder could hop ahead with trade freedom due to their currently higher protection levels and barriers.

| Factor | Impact on Growth |

|---|---|

| Trade | Higher growth rates |

| Foreign Direct Investment | Increased economic growth |

| Trade Barrier Elimination | $250 – $680 billion gains annually |

Nonetheless, not all industrialized nations swim in the same prosperity pool due to globalization. Those with less wealth might not clinch the same benefits as richer ones. The knack of other countries in certain industries offers a big shake to local industries. What’s more, globalization can lead to natural resources being stripped tightly to meet production targets (Investopedia).

For a deeper dive into how different nations stack up economically, check out resources like the list of countries by GDP, list of developing countries, and list of developed countries. To see how economic policies are molding different regions, take a gander at the list of third world countries and peek into other regional reports.

When you piece together real GDP trends with globalization’s impact, you start to get a real sense of the gears and levers steering global economic growth. It gives a fresh look at how our economic surroundings keep morphing.