Introduction to Wealthiest Countries

Ranking Overview

When you’re figuring out which countries are rolling in dough, you’re basically looking at stuff like GDP per person. It’s a handy measure that tells you how much wealth a country churns out on average for every guy and gal living there. Gives you a snapshot into their financial health and the standard of living they enjoy.

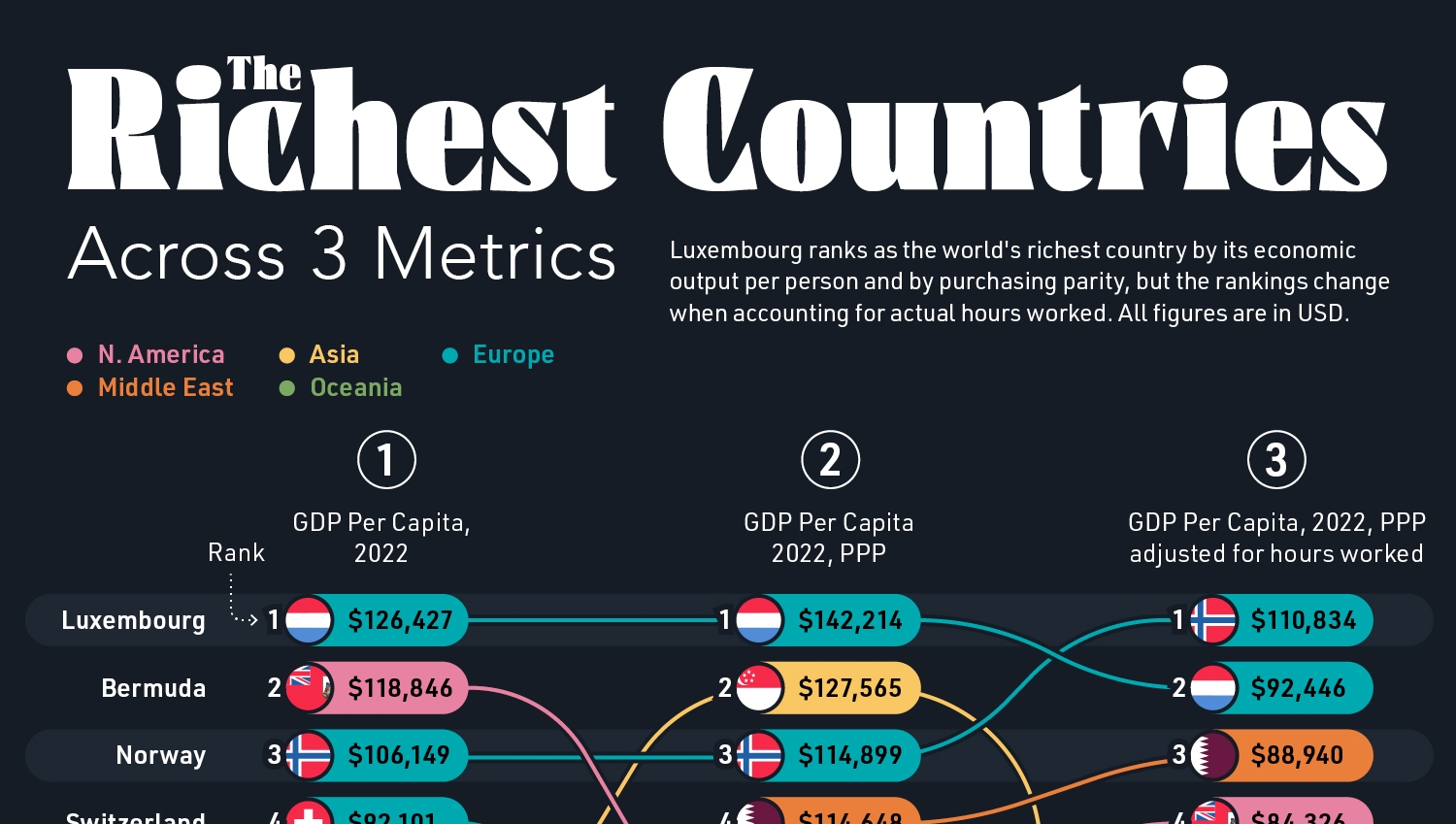

Some nations keep popping up at the top because of their savvy economic strategies, rich resources, and smooth-running financial setups. Take Luxembourg for instance. Tiny but mighty, it snagged the number one spot back in 2017, according to the experts over at the International Monetary Fund. Luxembourg boasts a mixed-bag economy known for solid financial services and top-tier productivity.

Below’s a glimpse at a few countries that frequently flaunt their fat wallets:

| Country | GDP per Capita (International $) | Notes |

|---|---|---|

| Luxembourg | $131,529 | Jack-of-all-trades economy, financial services wizard |

| Qatar | $112,283 | Sitting on a goldmine of natural gas |

| Singapore | $133,737 | Heaven for the rich looking for tax breaks |

| Switzerland | $99,994 | People are buying powerhouses |

| Norway | $94,606 | Rakes in big bucks from oil and gas |

Take Qatar—jam-packed with natural gas, it’s been sporting one of the heftiest GDPs per person for the last couple decades. Not to be outdone, Singapore’s a magnet for the mega-rich, thanks to its status as a tax haven (bragging rights come with a GDP per capita of $133,737).

Then there’s Switzerland, where the average person does quite well with close to $100,000 in GDP per person. With a population of 8.9 million, they make the list due to their sturdy economy and hefty buying power.

For a closer peek at Europe’s economic powerhouses, check out this list of European countries or see how countries rank globally with GDP list of countries by GDP.

Looking at what pushes these places to financial fame reveals a lot about how resources, financial savvy, and good governance come together to create prosperity. You might wanna read up more with our takes on the list of developed countries and list of countries by human development index.

Top Wealthiest Countries

Peeping into the list of mega-rich nations, you’ll notice a few countries stand out, waving from the top with their hefty wallets thanks to booming economies, money-spinning services, and bountiful natural resources. Let’s chat about the elite trio: Luxembourg, Switzerland, and Qatar.

Luxembourg

This tiny spot in Western Europe frequently nabs the crown in wealth contests. Fast forward to 2023, and Luxembourg flaunts the highest purchasing power out there, with a GDP per person clocking in at $128,259. Credit their good fortune to the financial services scene, where banks are like magnets for deposits from all corners of Europe and beyond.

| Year | GDP per Capita (USD) |

|---|---|

| 2017 | 107,641 |

| 2023 | 128,259 |

Wanna peek more into Luxembourg’s financial games? Check out our list of eu countries.

Switzerland

Switzerland, always reliable with its rock-solid finanical scene and banking know-how, pops up high on the money list. Sporting a GDP per capita of $91,932, this place shines with its money maestro image and top-notch manufacturing skills (Global Finance Magazine). But they’ve got hurdles to hop over, like the pandemic’s economic hiccups and depending on energy imports.

| Year | GDP per Capita (USD) |

|---|---|

| 2017 | 80,189 |

| 2023 | 91,932 |

Curious about Switzerland’s tale? Hit up the list of european countries.

Qatar

Qatar, rolling in riches from its oil and gas stash, has been among the upper crust for ages. At $112,283 in international dollar value per person, Qatar’s wealth is a mix of juicy resources and a lean populace of around 3 million folks (Global Finance Magazine). Even when energy prices play hard to get, this economy is set to bump up about 2% come 2024 and 2025.

| Economic Indicators | Values |

|---|---|

| GDP per Capita (USD) | 112,283 |

| Population (millions) | 3 |

For more on Qatar, have a gander at the list of countries by land area.

These nations show off how cracking financial sectors, brainy resource handling, and a chunky GDP per person help them keep a VIP spot among the world’s economic powerhouses. Want more rankings like this? Swing by our list of richest countries.

High Per Capita GDP Nations

Check out the cream of the crop when it comes to rich countries—the ones snapping up high spots on the charts with their sky-high per capita GDP. Leading the pack are the United States, Singapore and Denmark. These nations aren’t just sitting on piles of cash; they’ve got the numbers to back it up.

United States

Ah, the United States, where you can find the Grand Canyon and giant GDP numbers all in one place. It’s got a whopping GDP of $27,974 billion and flaunts a GDP per capita of $83.06K. This country doesn’t just toss around dollars like confetti; it’s really earning ’em (Global Residence Index).

| What’s What | Details |

|---|---|

| Total GDP (Billion $) | 27,974 |

| GDP per Person (Thousand $) | 83.06 |

Get nosy about economic status worldwide with this list of countrys economic status.

Singapore

Singapore, where wealth isn’t just on paper; it’s in their DNA. With a GDP per capita of $133,737, this city-state is a magnet for wealthy folks, given its no-tax policies on capital gains and dividends. However, it hit a speed bump in 2020, witnessing a 3.9% economic slip due to global chaos and less bond with China.

| What’s What | Details |

|---|---|

| GDP per Capita (Thousand $) | 133.737 |

| 2020 Economic Red Light (%) | 3.9 |

Want to get to know Asia better? Take a peek at the list of asian countries.

Denmark

Denmark, the land of pastries and prosperity, houses 6 million folks who enjoy a comfy GDP per capita of $67,967 in 2023. This isn’t just about money—Denmark aces healthcare, living costs, and buying power. If you’re looking for quality vibes, Denmark’s a strong contender.

| What’s What | Details |

|---|---|

| GDP per Person (Thousand $) | 67.967 |

| People Count (Million) | 6 |

Dig deeper into European wonders with the list of european countries.

These powerhouses aren’t just wealthy—they’re running economic marathons with grace and style. For a peek at who’s at the top of the global money tree, swing by our list of richest countries.

Influence of Natural Resources

Natural resources are the hidden gems that can either springboard a country’s economy or hold it back like a stubborn mule. They dictate the dance between wealth and poverty on the global stage.

Impact on Economic Development

Take a stroll back to 1970, and you’ll see how the world’s appetite for natural resources has exploded, more than tripling since that groovy era. Think of Britain back in the day, fueled by coal and iron—they were the marathon runners of the Industrial Revolution (PBS NewsHour).

For countries blessed with an abundance of natural resources, it’s like hitting the jackpot in the economic lottery. These nations are the overachievers, pumping up their industries and paving way to top-notch infrastructure. You know, the kind that leaves low-income countries with their humble 2 tons of material wishing for more (IISD).

| Income Group | Material Footprint (Tons per Capita) |

|---|---|

| High-rollers | 27 |

| Penny-pinchers | 2 |

For some countries, it’s like having a first-class airline ticket to the list of first world countries.

Resource-rich Microstates

Now let’s talk about the little guys who punch above their weight. These resource-rich microstates might be small, but they’ve got nature’s treasure chest on their side, anchoring their economies.

- Qatar: With enough natural gas and oil to make Scrooge McDuck jealous, this tiny nation sits cozy among the wealthiest in the world by GDP per capita.

- Luxembourg: While not exactly equipped with over-the-top natural resources, it uses its brains—financial services and nifty tax tricks—alongside a bit of help from its modest natural resources.

- Brunei: Blessed with pools of petroleum and gas, Brunei reaps the bounty, securing its spot in the loaded countries club.

These mini-sized powerhouses show that with smart resource management, even the little guys can play with the big dogs on the economic field.

Look down the list, and you’ll find IMF crowned countries like Luxembourg, Ireland, and Switzerland as royalty in GDP per capita by April 2024 (Investopedia).

Catch a glimpse of how natural resources sway the wealth scales across the globe by checking out the list of african countries and the list of european countries. These lists peel back the curtain on how nature’s bounty—or lack thereof—creates wealth puzzles across different regions.

Factors in Economic Prosperity

Getting down to the nitty-gritty of what makes some countries swimming in cash involves checking out a couple of big plays in the game. We’re talking about the power of the finance world and the bling they rake from their natural riches.

Financial Services Sectors

Picture places like Luxembourg, Switzerland, and Hong Kong—they’re not just teeny on the map; they pack a punch where it counts: finance. As financial sweet spots, they’ve got folks from everywhere tucking their cash away here, thanks to slick banking and top-notch money managers (Global Residence Index).

Over in Luxembourg, which might be small enough to miss but isn’t when it comes to cash, they hit a GDP of $128,259 per person in 2023. This place is sitting pretty thanks to being a big deal in the world of money (Investopedia).

Now, check out Switzerland. It’s not just known for yodeling and watches—its banking game is strong. With $99,994 in GDP per person, they’re serving wealthy folks and companies around the globe with a slick economy based around banking and finance.

| Country | GDP per capita (2023) | Key Economic Muscle |

|---|---|---|

| Luxembourg | $128,259 | Financial Wits |

| Switzerland | $99,994 | A Banking Big Wig |

Revenue from Natural Resources

Then you’ve got those rolling in the dough from what they dig up out of the ground. Places like Qatar and Norway are cashing in hard on their oil and gas treasures.

Qatar, that sneaky little state in the Middle East, nearly swims in oil and gas. The dough from these fuels gives it one heck of a high GDP, making it quite the star in the wealth world.

Take Norway, for another example. They’ve cashed in on oil and gas so much they’ve banked a seriously chunky sovereign wealth fund. That’s just one of the ways they’re stocking up the vaults (Global Residence Index).

| Country | Natural Treasure | Big Earns |

|---|---|---|

| Qatar | Oil and Natural Gas | Huge GDP per person from selling stuff |

| Norway | Oil and Gas | Mega stash in the sovereign fund |

Peeping into all this shows why some spots lead the pack in global wealth. Between savvy finance moves and rich resources, they’ve got the winning formula. Curious about how the money game plays out in different regions? Check out more on the wealth splits and growth stories in list of european countries and the list of countries by GDP.

Regional Disparities

Some places roll in riches; others are stuck in neutral, and a lot of that boils down to where they plopped down on the planet. With a bit of nature’s luck, some regions are blessed with resources like coal, oil, or natural gas, serving them a big plate of economic boom potential, while others get stuck trying to catch up.

Influence on Economic Growth

Think of natural resources as the behind-the-scenes fuel for many economies. The United Kingdom, for example, got quite cozy during the Industrial Revolution, feasting on its coal and iron goodies (PBS NewsHour). It’s these resource-rich nations that often leap ahead of the pack when it comes to growing their economic muscle.

But it’s not just about having the right stuff in the ground. Some areas wrestle with hard realities like disease, which can throw serious curves into economic progress. High mortality rates due to health scourges slap down investment in education and literacy, both of which are vital for a booming economy. Lots of regions have felt this sting (PBS NewsHour).

Role of Geography

Nature didn’t exactly hand out resources and geography with a fair ruler. Fertile land and waterways are like the fast lanes to economic success—useful for things like farming and sending goods about (PBS NewsHour).

A cool study crunched numbers on per capita income and guess what? Fossil fuels and ports made up nearly 58% of why some places are rolling in it. Toss in things like hydroelectric power, malaria, and land quality, and the income variation shoots up to 75% (PBS NewsHour).

| Factor | Influence on Income Variation |

|---|---|

| Access to Fossil Fuels | 58% |

| Proximity to Ports | 58% |

| Bonus Factors (e.g., hydroelectric power, malaria) | 75% |

From what’s underfoot to sea routes, these factors give some countries a leg up. For a peek into how big a piece of land they’ve got to play with, check out our take on list of countries by land area. Scooping up insights on these topics is key to untangling the reasons some countries find themselves on the list of richest countries while others are still trying to join the party.

Leading Factors in Income Variation

Why does one country have a fat wallet while another is just scraping by? It mostly boils down to a few big players: how much they rely on fossil fuels and whether they’ve got ports. These elements are basically the secret sauce behind a nation’s economic happiness or misery, giving us a peek at why some nations make it big on the list of the richest countries.

Fossil Fuels Dependency

Fossil fuels are like gold for countries lucky enough to have them. Oil and gas are the superheroes that drive economic growth since they rake in serious dough from exports. Take Qatar and Kuwait, for instance— they’ve hit the jackpot with their massive reserves.

- Contribution to GDP: For nations blessed with resources, fossil fuel industries are like the golden goose, laying eggs that boost their Gross Domestic Product (GDP) and, in turn, their wallets.

| Country | Main Resource | GDP Contribution (%) |

|---|---|---|

| Qatar | Natural Gas & Oil | 60% |

| Kuwait | Oil | 50% |

As noted by PBS NewsHour, these stats illustrate how crucial natural resources can be.

- Economic Stability: Fossil fuels can be a double-edged sword: solid in tough times but unpredictable when markets go haywire. Countries heavily leaning on them need a backup plan for stability when global oil prices decide to take a roller-coaster ride.

Nations can’t just sit back and let oil do all the heavy lifting forever. Diversifying their economies isn’t just smart; it’s necessary. Want tricks of the trade? Check the list of developed countries for how others have played their cards right.

Access to Ports

When it comes to geographical perks, having ports is like holding an ace. Countries near the water can trade like pros, cut down on shipping costs, and boost their economic performance thanks to these maritime lifelines.

- Trade Efficiency: Ports are like the fast lane for goods, allowing countries to swap imports and exports without breaking a sweat. Coastal nations often ride this wave to economic success, leaving their landlocked buddies trailing behind.

| Country | Average Distance to Port (km) | GDP Per Capita ($) |

|---|---|---|

| Singapore | 0 | 64,580 |

| Denmark | 0 | 60,230 |

| Switzerland | 55 | 83,832 |

The source is the International Monetary Fund (IMF), showing how position matters in the money game.

- Economic Development: A spot by the sea doesn’t just help trade. It turns up the dial on everything from farming to industry to services, making stuff move lickety-split. That’s partly why Singapore and Denmark are living the high life.

For countries stuck in the middle with no sea from which to ship, climbing the economic ladder is a tad harder. Without port access, they’re looking at higher transportation costs and a tougher time competing globally. To dig deeper into how geography plays in, skim through the list of landlocked countries.

So there you have it—fossil fuel dependency and port access are the unsung heroes and villains dictating a country’s wealth. Understanding these factors gives you a backstage pass to the economic show that lines up nations on the list of richest countries.

Historical Development

How countries turn the natural goodies in their backyard into cash cows tells a lot about their past and future. From minerals buried underground to that perfect spot on the map, these juicy perks have shaped not just the wealth but the very DNA of economies around the world.

Impact of Natural Resources

Mother Nature plays a big part in fueling progress. Take Britain and its stash of coal and iron. This combo powered up the steam engine, catapulting the nation to prosperity during the Industrial Revolution. Talk about hitting the resources jackpot!

Take this to the bank: A study found that access to fossil fuels and a good spot by the water explain a whopping 58% of the difference in incomes between countries. Throw in some extra goodies like hydroelectric potential, fertile land, and a comfy climate, and this decked-out resource package explains 75% of the income variations. That’s Mother Earth’s blessing for economic bliss!

Geographical Advantages

Your place on the map gives you a front-row seat to prosperity or leaves you in the economic bleachers. Good soil for farming, lots of water routes, and staying healthy give economies a major leg-up. Got those? Then you’re likely swimming in a river of wealth.

Shape, size, and where you are in the world matter. If resources are easy to grab, climate’s in the sweet spot, and you’re positioned for trade, then your economic wheels start turning faster. Overcoming a lack of these perks isn’t impossible, but with them, you’ve got a head start.

But it’s not all sunshine and roses. In places where disease runs rampant due to geography and climate, economic growth can massively stall. High mortality rates pull focus away from investing in vital areas like education and research. Keeping people alive and healthy turns out to be a major economic booster.

These historical bytes are keys to understanding why some countries are rolling in dough while others juggle economic challenges. For more nitty-gritty insights, check out our article on how some regions zoom ahead economically while others lag behind. For a global look-see, dive into our list exploring countries by their human development scores.

Disparities in Per Capita Income

Poorest vs Richest Nations

There’s a big ol’ gap between the poorest and richest nations when it comes to per-capita income. Countries scraping the bottom rungs have an average buying power of less than $1,500 per person, while those rolling in dough enjoy more than $110,000. This eye-opening gap screams economic inequality across the world.

| Category | Average Per-Capita Income |

|---|---|

| Top 10 Richest Nations | Over $110,000 |

| Top 10 Poorest Nations | Less than $1,500 |

Curious about how different countries stack up? Check out our list of developed countries and list of developing countries for more insight.

Influencing Factors

Several things stir the pot of economic disparity between countries:

- Access to Natural Resources:

- If a country’s got the goods, they’re sitting pretty. Take Britain, for example; they struck it rich during the Industrial Revolution thanks to their trove of coal and iron. Having oil in the backyard also leads to some chubby coffers.

- Geographical Location:

- Where a place is plopped on the map and its climate can really make or break its economy. Nice weather and waterways equal easier trade and luscious crops, boosting financial health. On the flip side, diseases tied to the local ecology can stall progress like nobody’s business (PBS NewsHour).

- Economic Policies and Governance:

- Good governments know how to roll out policies that help economies grow like weeds. Countries that have their regulatory ducks in a row and open doors for investments zoom past those who don’t.

Want to dig deeper into how these disparities affect growth regionally? Swing by our Regional Disparities section.

- Education and Health:

- Countries paying attention to schools and clinics often have healthier, more skilled folks. This leads to more elbow grease and higher productivity. But if diseases are holding the populace back, you can bet those necessary investments won’t be happening.

Peeling back these layers helps us understand why the financial chasm is so massive among nations. For a closer look at different country groupings, pop over to our lists of first world countries and third world countries.